Author Jason Monteleone, President, Ancillare

I have been looking forward to completing this article since I’ve had limited opportunity to write due to competing priorities – we sent our eldest off to college (Go Clemson!), moved to a new house and I started a new role as President of Ancillare. Ancillare is a full service global provider offering customized ancillary supplies, equipment and kitting solutions for clinical trials. Prior to Covid I never thought about ancillaries, that changed after numerous client calls discussing supplies stuck in customs or not available due to supply chain constraints. Ancillare has provided me the opportunity to learn more about this rarely discussed (but extremely important) component of the clinical trial process.

What Are Clinical Trial Ancillaries?

The short answer is any non-drug items needed to execute a clinical trial. Examples would be refrigerators/freezers, centrifuges, sharps containers and medical disposables. Costs associated with ancillaries include equipment/supplies, sourcing, logistics (i.e. freight), kitting, storage, reclamation/destruction, project management, importer of record and taxes where applicable. Having an ancillaries partner with strong manufacturer relationships, a global distribution network, medical/clinical product expertise, strong operational delivery and a dedication to quality. Lastly, understanding regulatory requirements is essential to keeping patients safe and staying within regulatory compliance.

Clinical Trial Ancillary Supplies/Equipment/Kitting Market Size

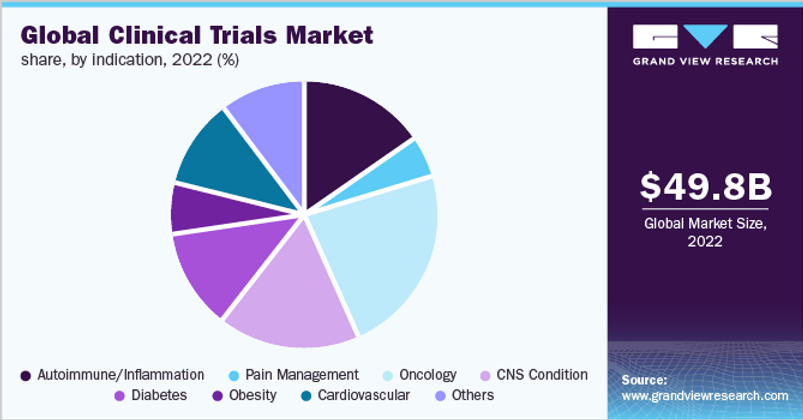

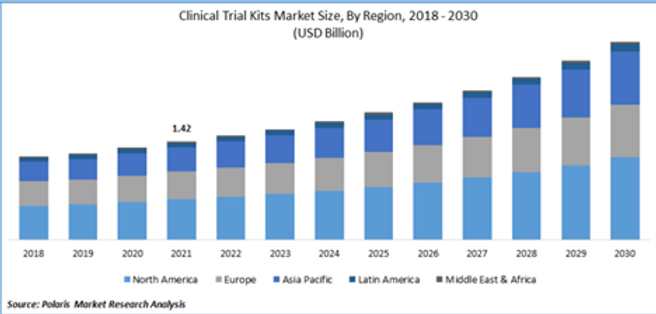

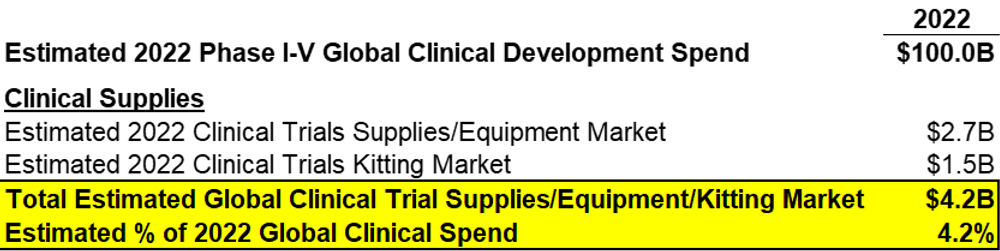

Two segments make up the overall ancillaries market: 1) Global Clinical Trial Equipment & Ancillary Solutions and 2) Clinical Trial Kits (I’ll refer to the combined as ancillaries to keep it simple). You can see from the charts below (taken respectively from postings by Grand View and Polaris Market Research), that the overall market was a substantial $4.2B in 2022. Expected growth rates are robust as well:

- Equipment & Ancillary Solutions are forecasted to have an 8.1% compounded annual growth rate (CAGR), resulting in a $5B market by 2030.

- The Clinical Trial Kits market is projecting a CAGR of 8.3% resulting in a $3B market by 2030.

- Combined we are looking at a potential $8B market by 2030.

- Other quick facts are that North America is currently the largest market, Asia-Pac is growing the fastest and Phase 3 projects (no surprise) represent the most spend.

Global Clinical Trial Equipment & Ancillary Solutions Market

Ancillaries Impact on Clinical Trial Costs

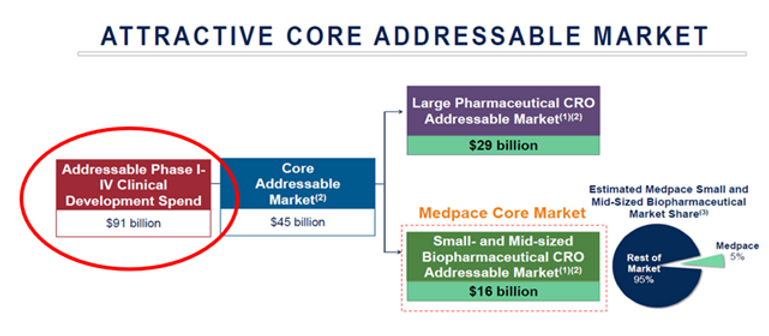

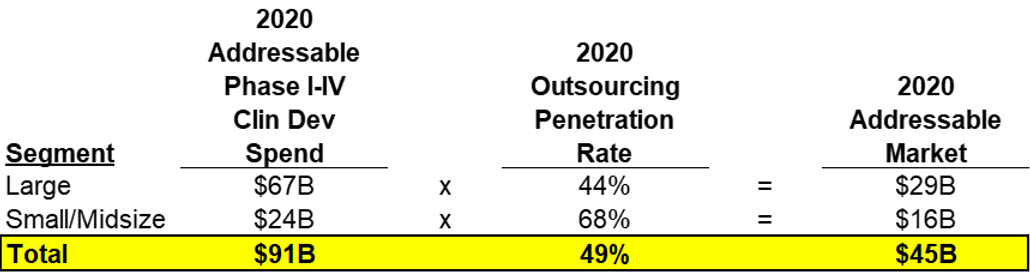

Let’s dig a little deeper and better understand the financial impact that ancillaries have on clinical trials. Quantifying the addressable Phase I-IV Global Clinical Development spend for large, midsize and small pharma/biotech is a logical first step. Medpace had a great slide in their 2020 William Blair Healthcare Meeting presentation (see below). Medpace reported back in 2020 that overall Phase I-IV Clinical Development Spend was $91B with an addressable market of $45B (split between $29B for Large Pharma & $16B for the Small/Midsize Market). You can see the slide below.

I’ll walk through how Medpace calculated the addressable market using the fine print on their slide. Medpace determined with their own analysis along with other industry reports that the outsourcing penetration rates for large and small/midsize pharma were 44% and 68% respectively. The outsourcing penetration rate is the amount of clinical development work that each segment is outsourcing to Clinical Research Organizations (“CROs”). Medpace calls this out to demonstrate its addressable market which is total clinical development work outsourced to CROs. In summary, Medpace estimated that in 2020, there was $46B of clinical development work completed in-house and $45B outsourced to CROs (totaling $91B of global Clinical Development spend on Phase I-IV Clinical Trials).

I wanted to sanity check Medpace’s analysis so I compared their $45B addressable market to another Grand View Research report (see below). Grand View estimates that the 2022 Clinical Trials Market was $49.8B (which is in the ballpark of Medpace’s $45B estimate). Assuming some growth from 2020 (Medpace’s estimate) to 2022 (Grand View’s estimate), I feel comfortable we are working with reasonable estimates.

Now that we have a reasonable estimate for 2020 Phase I-V Clinical Development spend ($91B), I’ll assume growth (from 2020) and that 2022 spend was around $100B. Grand View and Polaris’s reports estimated that the Ancillary Supplies/Equipment & Clinical Trial Kitting markets were about $4.2B combined or 4.2% of total 2022 Phase I-IV Clinical Development spend. $4.2B is a clearly a sizable expense within the drug development industry.

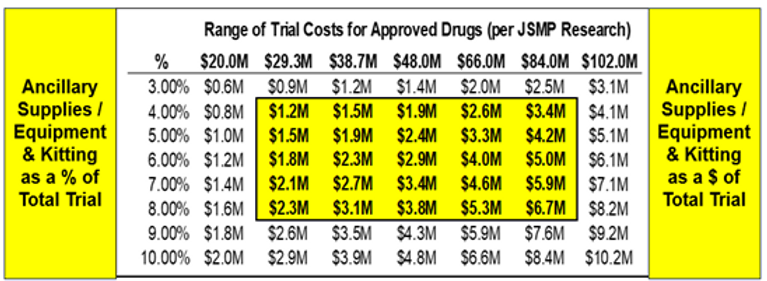

I completed a sensitivity analysis to break down ancillary expenses to the study level. BMJ Journals (a weekly peer-reviewed medical trade journal, published by the trade union the British Medical Association) published a research paper measuring the cost of pivotal trials per approved drug. Results were:

Using the median cost of $48M and a range of $20M-$102M along with Ancillary Supplies/Equipment/Kitting representing 4.2% of Phase I-IV Clinical Development spend, I created the sensitivity chart below. The potential ancillary supplies/equipment/kitting costs could represent anywhere from $1.4M to $4.8M of a $48M clinical trial (keep in mind 4.2% was the % of overall Clinical Development spend that figure can go increase/decrease depending on study attributes (which is why I created the sensitivity chart). Ancillaries are a significant clinical trial expense that require close management. Not to mention the quality, timing and strategic components of the process as well. There is definitely a sweet spot between price, quality, timing, etc… Much like selecting a CRO, going with the lowest cost option, may not give you the most effective solution in the long run.

Ancillaries Cost Drivers

Numerous factors impact the overall ancillaries cost. Below are a few to think about:

- Proactivity/Planning – Key point that often gets overlooked with ancillaries. Finding stories about how slow patient recruitment, site identification and site startup can prolong the length and cost of a clinical trial is easy, (not so much with ancillaries). Clinical trials can’t start without the correct ancillaries being at the site in time for patient visits. Without proper planning study costs could increase simply due to not having ancillaries available to execute the study.

- Economies of Scale – Larger studies can definitely have efficiencies on a per site or per patient basis. For example, sourcing one freezer in one country takes the same amount of time to source ten freezers in one country. Sourcing costs are spread over ten units instead of one.

- Sourcing Strategy – Someone could write a book on sourcing strategy. The determined sourcing strategy has a huge impact on total costs. 100% local country sourcing should have the lowest costs as there would be significant freight savings (and reduction in timing risk). Centralized sourcing (i.e. sourcing all items in one country and then shipping worldwide from a single site) would have the highest freight costs and risk (having items stuck in customs as an example). Since we know clinical trials are complex, many projects have a hybrid approach that optimizes local and centralized sourcing to produce cost and operational efficiencies with lowered execution risk.

- Therapeutic Indication – As with all clinical trials, therapeutic indication will dictate the types (and expense) of ancillaries involved.

- Trial Design – The greater the number of patients, sites and visits will increase the number of procedures (and total cost).

- Trial Geography – Large global projects should provide efficiencies on per patients basis, but will require an increased budget amount due global management oversite required.

Wrapping Up

Clinical trial ancillaries are an often overlooked and underestimated component of both clinical trial budgets and operating plans. Quite often ancillaries are managed by staff without the deep experience required to understand the necessary sourcing and logistical intricacies to manage a successful trial. Clinical trial ancillary strategies will become even more important as decentralized clinical trials drive ancillaries going directly to patients or mobile clinical trial units. Hopefully I was able to shine a light on a $4B industry that works in the background but is a part of every successful study. Lastly, a shameless plug for my new employer: Please visit us at Ancillare.com to learn more.

Author

Jason Monteleone joined Ancillare as President in October 2022, bringing extensive expertise in the clinical trial pharmaceutical outsourcing services sector. He most recently served as Chief Business and Strategy Officer at dMed-Clinipace — a global mid-sized Contract Research Organization (CRO) — and Chief Executive Officer at Clinipace prior to its 2021 merger with dMed.

Jason presently serves as a Director for the Drug Information Association (DIA), a global organization dedicated to uniting life sciences professionals across more than 80 countries to share insights and drive actions in healthcare product and life cycle management.